Because it recognizes revenues and expenses when they are earned or incurred, rather than when they are paid or received, accrual basis accounting may not always reflect the actual cash inflows and outflows of the business in the short term. Accrual basis accounting can sometimes provide a less accurate picture of a company's short-term cash flow.

This can require more record-keeping and can be more difficult for some companies to manage.

ACCRUAL BASIS ACCOUNTING RECOGNIZES HOW TO

For example, accrual basis accounting provides information about a company's accounts receivable and accounts payable, which can help decision-makers to assess the company's financial health and make decisions about how to manage its cash flow.

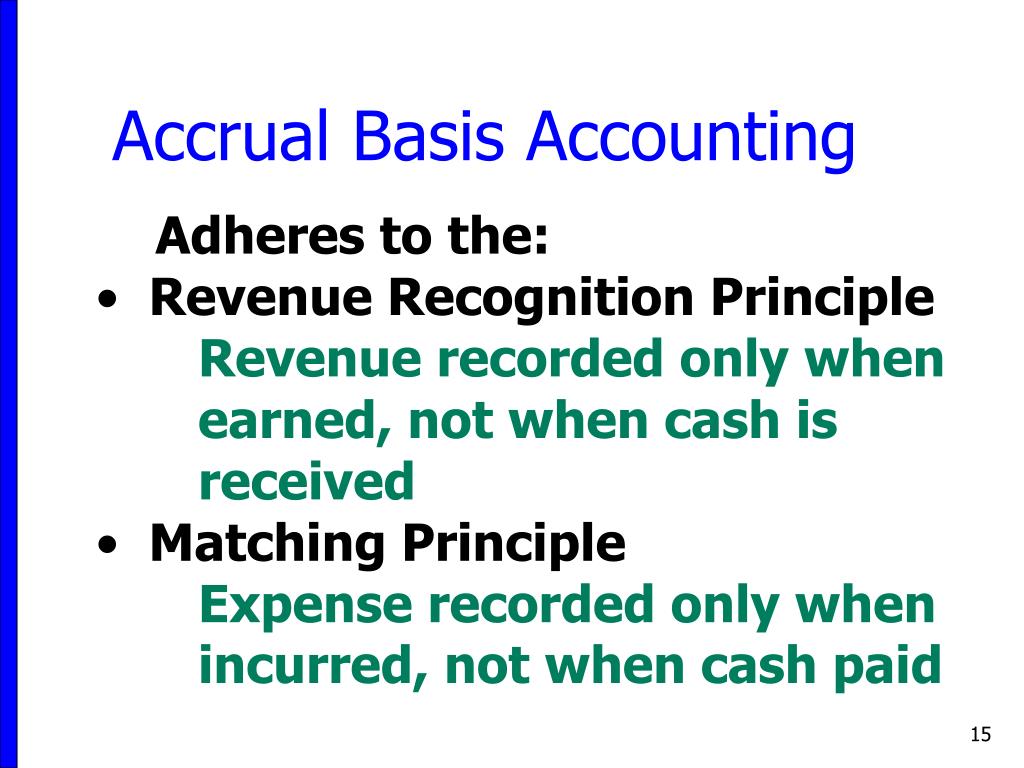

Accrual basis accounting provides more information to decision-makers, which can help them to make more informed decisions.Accrual basis accounting provides a more accurate picture of a company's financial performance and company's profitability because it takes into account all of the company's revenues and expenses, regardless of when they are paid or received.This is because it takes into account not only the cash inflows and outflows, but also the revenues and expenses that have been earned or incurred but not yet received or paid.Īdvantages of Accrual Basis of Accounting The accrual basis of accounting is considered to be more accurate and provides a more complete picture of a business's financial performance. It does not provide a complete picture of a business's financial performance and is not in compliance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). The cash basis of accounting is simpler and more intuitive. Similarly, if a company incurs expenses on November 30 but doesn't pay for them until December 15, the expenses would be recognized in the accounting records on November 30, the date they were incurred, rather than on December 15, the date they were paid.ĭifference Between Accrual Basis and Cash Basis If a company provides a service to a customer on December 1 and sends an invoice for the service on December 15, the revenue from that service would be recognized in the accounting records on December 1, the date the service was provided, rather than on December 15, the date the invoice was sent. To illustrate how the accrual basis of accounting works, let's consider an example. This means that revenues are recognized when goods or services are delivered to a customer, rather than when payment is received, and expenses are recognized when they are incurred, rather than when they are paid.

ACCRUAL BASIS ACCOUNTING RECOGNIZES SOFTWARE

What Is Accrual Basis of Accounting and How Does It Work? Posted In | Finance | Accounting Software | Gridlex AcademyĪccrual basis accounting is a method of accounting that focuses on recognizing revenues and expenses when they are earned or incurred, rather than when they are paid.

0 kommentar(er)

0 kommentar(er)